Plastic Companies in Ghana are said to be running to Ivory Coast because of the proposed 5% Excise tax on plastic products by the Government.

This was disclosed at a press conference by the President of Ghana Plastic Manufactures’ Association (GPMA), Mr. Ebbo Botwe.

“Some Plastic Companies originally operating in Ghana has already relocated to Ivory Coast and the feedback is good, sending a signal of more to follow if the draconian tax is finally implemented. The proposed 5% Excise Tax On Plastic products”.

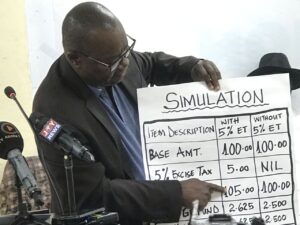

According to GPMA President, the new tax would push all locally manufactured plastic producers from the market because, prices would be more expensive as compared to those imported.

He said currently, two major plastic companies are running simulation exercise projects in Togo to consider a potential relocation and export the finished goods to Ghana leading to job losses.

“What we are saying is that, the 5% Excise Tax in its current form is harsher on the common man and this will translate into at least 28% increase in prices of plastic packaging and all plastic products in Ghana and reduce competition and relocating of companies”.

The plastic industry in Ghana he revealed, employs over 39,260 people and generate over 1.89 million jobs in the plastic waste recycling sector and a further 1.43 million jobs in the sachet and bottling water sub-sector.

“So approximately, we are looking at the plastic industry given both direct and indirect jobs to about 3.71 million contributing to at least 11% of Ghana’s population and at number 5 of Ghana’s Commodity Export after gold, oil, cocoa and cashew.”

Mr. Ebbo Botwe therefore, called on the Government to as a matter of urgency, suspend the Ghana Revenue Authorities (GRA) draconian 5% tax on the locally manufactured plastic products.

He lamented that, the implementation of the 5% Excise tax would not only collapse businesses but, it is also going to increase the price of local plastic products and eventually, cause them to lose market competition for other plastic products coming from China and other countries.

Mr. Botwe pointed out that, GPMA was not consulted before, during, or after finalizing the tax regime. “We don’t know what factors were considered in coming up with this Consumer Tax”.

The new tax Mr. Ebbo Botwe indicated, means an additional tax to the already 10 Environmental Excise Tax on selected plastic materials at the entry ports and that, it is going to increase the cost of plastics and plastic packaging including the cost of sachets water in the country.

He hinted further that, about 92% of the industries in Ghana heavily rely on plastic packaging and products saying, the new tax would eventually contribute to an increase in all plastic products serving as a burden to the consumer.

“The 10% Environmental Excise Tax as of December 31, 2023, has accrued more than GHC1.976 billion since its inception in 2011. The aim was to tackle the plastic waste menace but not a single pesewa has been disbursed so, adding the 5% Excise Tax will be adding salt to injury.

The 5% Excise Tax according to him, would adversely affect the general manufacturing business community and compound the living conditions of the everyday consumer because currently, most companies have suspended production, putting workers on wholesale leave due to the high foreign exchange rate, benchmark values, and high operating overhead cost.